Financial Responsibility Is Key

CEO Business Visits

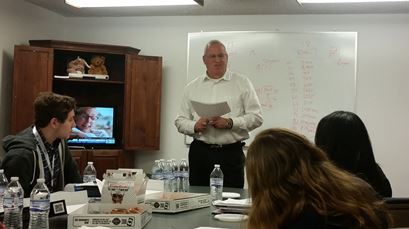

CEO Guest Speakers

Trinity Financial Group

Mike and Verna Dunnigan, Owners

The Belleville CEO class visited Trinity Financial Group on Monday and were taught an interesting lesson on how to double our money. Mr. And Mrs. Dunnigan coached us on saving, investing, and making smart decisions with the profit of our businesses. They taught us about the Rule of 72. The Rule of 72 is a way to estimate the number of years that it would take for your investment to double. Thank you, Mr. and Mrs. Dunnigan, for allowing us to spend the morning with you both.

Written By Alayna Wells

Mr. Dunnigan shared that he has over 32 years of investing and his financial group manages just under $100 million in assets.

Mr. Dunnigan shared that he has over 32 years of investing and his financial group manages just under $100 million in assets. Mr. Dunnigan walked us through how people buy stocks and explained some investing terms like NYSE, the DOW, S & P 500, and selling short.

Mr. Dunnigan walked us through how people buy stocks and explained some investing terms like NYSE, the DOW, S & P 500, and selling short.Wenzel & Associates, LTD.

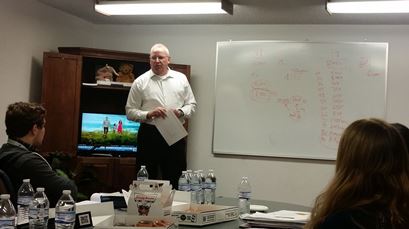

Mr. Mike Wenzel, President

On Tuesday, the Belleville CEO class had a wonderful visit by one of our investors, Mr. Mike Wenzel, with Wenzel & Associates, LTD. Mr. Wenzel's accounting firm is a small family owned businesses which specializes in tax and accounting support. He shared that many firms have become industry specialists due to the maze of regulations and rules set by the government. During his visit, Mr. Wenzel focused on how cash flow is the most important thing in a business. No cash flow can ultimately close a company. He also explained how you have to be able to sell your business. If you can’t sell your business or product, then your company won't have a very long future. Thanks Mr. Wenzel for sharing your knowledge with us.

Written By Alayna Wells

Reviewing Our Financials

Mr. Joe Mayoral & Ms. Shirley Koenig

On Wednesday, two U.S. Bankers, Mr. Joe Mayoral and Ms. Shirley Koenig helped the class by reviewing each of the students' start up expenses and three-year cash flow projections for their respective businesses. Thank you again, Mr. Mayoral and Ms. Koenig, for taking time out of your morning to help us with this part of our business plan.

Written by Alayna Wells

Competing in Entrepreneurship at State FBLA

Belleville CEO Student, Austin Thurman

Belleville CEO student, Austin Thurman is an active member of Future Business Leaders of America (FBLA) at Belleville East High School. Austin along with his FBLA partner, Mahlik Good, first competed in Entrepreneurship at the Regional Competition in January. They received a 2nd place award. This last weekend, Austin and his partner competed at State FBLA in Springfield and was awarded third place. Austin commented, "All of this community reinvestment does not come unanswered. I'm proud to say that my partner and I placed third in our event, Entrepreneurship, in the state conference this past weekend. Looking back at it, without CEO I would not have accumulated all of my business knowledge that's taking me to the National Conference in Anaheim this summer! Reinvestment of the community has taken me to new heights and CEO is responsible for these changes!" Congratulations again to Austin and his FBLA partner on their 3rd Place Finish at State FBLA!

Student Journal Highlights for this week

On Monday, we visited Trinity Financial Group, Mike and Verna Dunnigan talked all about their business. Something that really stuck with me was how they grew up in small houses and when getting married were poor. Now they are multi millionaires and no one would even be able to notice. They have worked their tail off to get where they are now and feel the need to give back to the community. They are very involved with Belleville CEO and brought the chocolate fountain possible at our class business. Mike talked on how when his kid were younger he started investing money for his kids and when they are 65 they will be millionaires. I never thought on how putting away money each month will actually be able to make someone a millionaire.

On Tuesday, Mike Wenzel, with Wenzel & Associates, LTD visited us. During his visit he focused on how cash flow is the most important thing in a business. No cash flow equals no profit. He also explained how you have to be able to sell your business. If you can’t sell your business or product then your company won't have a very long future. He also is very involved in the community.

On Wednesday, we were visited by US Bankers to help us with our financials for our business plans. Our financials are actually a lot harder than they look. We didn’t have much help with financials until they came and they really did help us. Although, some of us weren't ready they still helped us even figure out what to do. They talked on how you need to love what you are doing and to show it to your banker when getting a loan. Everything should be ready and prepared before your meeting to receive a loan.

On Thursday, we did housekeeping and worked more on the financials with our business plan, because everything is due next Wednesday. I think the hardest part of the business plan is either the cash flow or having each paragraph long enough for the minimum criteria. You have to be in very much detail of everything you plan on doing and everything you have done.

Claire Randle

Friday, March 24, 2017Learn More About Claire

This week at CEO we visited the Dunnigans at Trinity Financial. We also met with Mike Wenzel and a few US Bankers to discuss financials.

We started the week by meeting with Mike and Verna Dunnigan at Trinity Financial Services. Mr. Dunnigan told us his story of how he got into his business, and I realized how crazy life can get. He told us how he used to work on shooting down missiles. He told us how crazy of a job it was and that the government was looking into him. He then left the job because it involved to much moving. He then started his own investment company, Trinity Financial, in Belleville. It was a crazy story and goes to show no matter your background, you can always find a way into the business world.

Another thing I really liked about their business was why they started their business. They explained how a bank goes and invests your money you put into it. They explained instead of letting the bank invest your money, you can do it yourself and make the profit instead of the bank making the profit. This seems like a simple idea but until they explained it I never would have thought about it. This really showed me there will always be things that you can do yourself to save money. A lot of businesses do things anyone can do, they just make it easier and convenient. If you aren't afraid of taking a risk, you can save the money and do it yourself.

We also met with Mike Wenzel. Mr. Wenzel had a lot of great information to share with the class, but two things really stuck out to me. First he said cash flow is the key to all business. If a business doesn't have money coming in or they don't track what money is going out, it will die. This is a lot of what Mr. Wenzel does, keeping track of a company's money. I also remember him stressing the importance of a good team. You want to build the best team you can. You want trustworthy people working with and for you, not people who are only in it for themselves. This can be very hard but it makes all the differences in a successful and failed business.

On Wednesday and Thursday we worked on our personal businesses. On Wednesday we had US Bankers look over our financials and make sure everything made sense. This was a great help and I feel like I understand the business world a lot better now.

Tim Donaho

Friday, March 24, 2017Learn More About Tim

Another week of CEO has passed. It is crazy to think that I only have one quarter left in my high school career. As the year is closing, the insanity of senior year is picking up. Classes are getting harder, prom and graduation are coming, and college is a few short months away. My personal business is coming along, and I have already had my first lesson for a little kid named Hunter. I hope to continue, and help Hunter grow into a better soccer player.

On Monday, we met with Verna and Mike Dunnigan. Mike is a financial advisor at his own business, Trinity Financial Group. He helps people with investing their money. He believes that stocks should earn money at a rate of 12%. If you put money in your bank account, you will make in between 1-2%. My grandfather and mother helped me set up a stock account. I really enjoy learning about the stock market. I want to be heavily involved with the stock market when I get older. I either want to be a stock broker, or put my money into a stock account to grow it. He taught us the rule of 72. If you take the rate, and divide it by seventy-two, it will give you the amount of years to double your money. If you invest 2,000 dollars at age 18, by age 80 you will be a multimillionaire. I think that this is extremely interesting. After learning about this business, I read about Warren Buffet and how he made all of his money through investments. I thought it was exciting, and plan to learn more and more about the stock market field. Hopefully, I will be able to make a career as a stock broker.

Mike Wenzel came to talk to our class Tuesday. He reviewed financials with us. One of the things he said that stuck with me was to set a goal. When creating financials, set a goal of money for a month and year. If you do this, you will be able to figure the amount of sales that you need to do over a short period of time.

The bankers came in on Wednesday, and they helped me a lot with my financials. I was missing the legal and insurance aspect. I need to figure that out before I continue. My mother is a lawyer so I need to talk to her about it. I also need to pay attention so that I pay myself. I need to figure out how much money that I want to make.

Stephen Waltrip

Friday, March 24, 2017Learn More About Stephen

This week in CEO our class on Monday met with the Dunnigans at Trinity Financial Group. I was extremely glad and thankful of the Dunnigans and all the help they did with the chocolate fountain at the Trade show but I never really knew who they were or what they did. Over the last year, I have really pondered if I should start an investment fund in the stock market through one of the investment firms in the area. I have no idea if I would be taken serious. If I had money they probably would or how I could even trust the people I would be handing thousands of dollars over to. I never got the chance to ask this but I wondered why people would choose Trinity Financial over some place like Fidelity or one of the other investment fund management places out there. If I start a portfolio at Trinity Financial Group, it would be hard to manage my account if I live in California. I would like to talk to a representative in person, so what makes their group better than places like Fidelity?

On Tuesday we met with Mike Wenzel. He gave us some insight into CPA’s and all that they do. Every time we meet with another accountant I always think what more could I learn from these accountants and every time I leave class knowing useful tips and ways to get the most out of a consulting CPA. These people have given me incredible amounts of information on how to start a business with solid financials, how to do the financials, and basic common sense accounting things that most people would not even take into consider when running a business. If I had not taken this class then there is no doubt in my mind that I would be utterly lost when I would have started my first business. It could even be a great idea and worked well but I know I would have still failed.

Joe Beussink

Friday, March 24, 2017Learn More About Joe

Week 29 of CEO featured two work days, one class visit, and one guest speaker. We went to my mentors business on Monday, Trinity Financial. Tuesday Mike Wenzel came in to help us with our personal businesses a little. Wednesday and Thursday we worked on our financials and personal balance sheets.

The visit to Mike Dunnigan’s business was very fun for me. He is my mentor and we regularly talk but it’s normally about baseball. I was excited to hear all about his professional life and learn more about his business. He runs Trinity Financial and his lovely wife Verna helps him run it. Trinity Financial is basically an investment consulting business. Lately I have been really interested in the stock market and that is exactly what they invest in. When I grow up I want to heavily invest in the stock market so maybe Mr. Dunnigan will be able to help me make good choices. He also taught us the Rule of 72. The rule of 72 is a shortcut to estimate the number of years required to double your money at a given annual rate of return. The rule states that you divide the rate, expressed as a percentage, into 72. Mr. Dunnigan says that the Rule of 72 is the most important lesson he can teach anybody because it can help people so much financially.

Tuesday Mike Wenzel came in from Wenzel & Associates and spoke to us about our personal businesses. He didn’t speak about himself or his business very much because he was so interested in helping us. He reminded us that cash flow is the most important thing in a business. We have heard that a lot this year so that’s how I know it must be true. He also said that no matter where we’re trying to go, we have to have a good team to get us there. This is also true because no business has become successful just because of one person with no help. Mentors, friends, family, and really any type of support is absolutely necessary to become successful. That’s why I believe Belleville CEO is so beneficial because we have made so many connections and all the people we meet are truly interested in helping us become great. If I ever hit a rough patch in my business I know I can pick any business card I got from this year and they will do their best to assist me.

Michael Lassman

Friday, March 24, 2017Learn More About Michael

The power of investment, important? Yes. So when is a good time to start? Having the privilege to speak with the Dunnigans from Trinity Financial they encourage us as young business owners to invest our money at a very young age. Of course I loved learning about the stock markets and all the financials that are a part of it. That's not what stood out to me. Investing in the youth is arguably the greatest investment in our country! In my opinion, this week was full of many examples of reinvesting in our youth. From my own experiences with the bankers from US bank whom helped us with our business financials all the way to the advisors at the FBLA state conference. This week was full of reinvestment from teachers all the way to business leaders. All of this community reinvestment does not come unanswered. I'm proud to say that my partner and I placed third in our event, Entrepreneurship, in the state conference this past weekend. Looking back at it, without CEO I would not have accumulated all of my business Knowledge that's taking me to the National conference in Anaheim this summer! Reinvestment of the community has taken me to new heights and CEO is responsible for these changes. As far as the rest of the year is concerned, I can't wait to learn more about our community in hopes of becoming a great entrepreneur one day!

Austin Thurman

Friday, March 24, 2017Learn More About Austin

From Mr. and Mrs. Dunnigan showing us how to double our savings to Mr. Mike Wenzel who taught us that cash flow in a business is what keeps it alive, our CEO week was eventful and informative. From keeping up with all of the new information we were given and trying to apply it to my business I learned that I need to take better notes of the small things that are discussed in our visits. Our successful speakers may be extremely smart and experienced in their respective professional fields but they would not be there without a passion for what they do.

I like to take away the stories and emotions from our speakers to get a better understanding of passion and how I can use mine about art to the best of my ability. Many stories about how these CEO’s get to their positions are similar to each other; however each story about the roots of their passion and how they first started caring about what they do are always captivating and vastly different from the last one.

This is the part of a business that you cannot control- so it makes it both the most important and most unpredictable aspect that anyone could apply. I already have a deep love for what I do and it shows through my creation and distribution of my artistic pieces to others who enjoy them. I am very excited to learn of the story and path to success my passion will lay out for me in the near and long term future of creating and running my art business.

Alayna Wells

Friday, March 24, 2017Learn More About Alayna

On Monday, our class went to Trinity Financial Group to meet Mike and Verna Dunnigan. Mr. and Mrs. Dunnigan are very close to their faith and it shows in their hard work and dedication. After hearing their story of starting a business, I was inspired to dedicate more time to my business. I learned that business is built on hard work, and it is crucial to be educated about the best ways to save money. I discovered tactics to pick and choose stocks to invest in as well as how to estimate when to sell them. Mr. and Mrs. Dunnigan taught me that anything is possible with hard work and to set high goals.

On Tuesday, our class was visited by Mike Wenzel from Wenzel and Associates, LTD. Mr. Wenzel taught me to always be prepared. I learned that it is important to think ahead in order to make a business successful. Being prepared allows you to be ready for any obstacle that might occur in the beginning of starting your business.

On Wednesday, our class was visited by some US bankers to help us review our business plan financials. I received positive feedback about my financials. I learned that it is important to also try to predict any costs or additional expenses to keep up your business for the next three years. I also learned that it is important to get your financials right and work really hard on them because the amount of loans banks are willing to give you for your business. I also learned that presentation is key and to be passionate about your business. Passion is noticeable to bankers, and they will be more willing to give you a loan if you appear very passionate about what you are doing.

On Thursday, our class had a work day to work on our personal balance sheets. Before doing the balance sheet, I did not know the difference between liabilities. Now, I know that assets are what you own and liabilities are what you owe. I discovered that I have a lot more assets than I originally thought. I also learned how to calculate net worth and how to do a personal property sheet.

Kaitlynn Borik

Friday, March 24, 2017Learn More About Kaitlynn

Starting off the wonderful week on Monday with a visit to Trinity Financial Group Which is owned by Mike and Verna Dunnigan who also serve as mentors for the Belleville CEO program. Our class learned a little on the stock market and about how valuable it really is to our society. I learned that investing money comes with a huge risk meaning you should always review and research your topic of investment or anything that you put your money into.

Starting Tuesday off with a visit from Mr. Mike Wenzel at Artigem Replacement Services. I picked up a lot of important aspects of business when listening to Mr. Wenzel. For example he asked each student what their personal business was and gave insight to everyone on how we could be different from our competitors and what could make us stick out from everyone else.

On Wednesday our class met with two US bankers to review our financials which are our start-up expenses and projections. When first looking at our financial part of our business plans I was completely lost and thought “wow what have I gotten myself into” but having these two bankers come in created discussion which enabled our class to understand more about the topics within our financials.

Ending our week on Thursday by starting our personal balance sheets. I also worked with Renae from Precision Practice Management and began to start on the CEO annual report. Starting my personal balance sheets was simple for me for two reasons, one being the low startup expenses and two being still based out of my home. Reviewing biographies and personal pictures will be my role in making this year’s annual report. Taking on this responsibility of the annual report is a big step because it reflects on both myself and each student in our program.

Devin Alexander

Friday, March 24, 2017Learn More About Devin

This short week for CEO began on Monday, where by meeting with Mr. And Mrs. Dunnigan at Trinity Financial. Next, on Tuesday we met Mr. Mike Wenzel at Artigem replacement services. On Wednesday we met at Artigem again with a couple of bankers to work on our financials. And finally on Thursday, we met at Artigem to work further on our personal balance sheets.

Like I said, on Monday we met at Trinity Financial. Here Mike Dunnigan spoke to us a lot about his job and the stock market. I really liked hearing from him, because after college I plan on becoming a broker. All of the things he talked about really interesting to me, and I'm glad that we were able to meet someone with such a career.

On Tuesday we met at Artigem with Mr. Mike Wenzel. Mike Wenzel is a CPA. He really interested me much like Mr. Dunnigan because both of their lines of work fall within the realm of finance which I plan to major in, in my time at SIUE.

On Wednesday we had a couple of bankers come in to help everyone individually with our financials. This was really helpful, because truth be told I did not have the slightest clue of what I was supposed to do on the spreadsheet. So their help was very gratefully appreciated.

Well in final, this was another great week for our Belleville CEO class, and I'm so excited to see what's coming in the weeks left. I'm also very excited that the classes personal businesses are coming together so well, and all of the great ideas seem like they have a lot of potential, which is really cool to see.

Cole Maul

Friday, March 24, 2017Learn More About Cole

Making money is art and working is art and good business is the best art. This week in CEO we learned about the importance of financials as we visited Mike and Verna Dunnigan at Trinity Financial services and we met with Mike Wenzel from Wenzel and Associates. This week was mainly about the importance of being financially responsible.

The week started at Trinity Financial Group as we met with Mike and Verna Dunnigan. As we all found a seat in the cozy room, eating Krispy Kreme doughnuts as fast as they put them on the table, Mr. Dunnigan told us about why he named his business Trinity. Mike Dunnigan is very religious and believes in the way of the Lord which is also what I agree with as well. He also told us about how when he was not in a good point in his life he wrote down everything that they spent to save money and he taught us about the Rule of 72. The Rule of 72 is a way to estimate the number of years it takes for a certain variable to double. To estimate the number of years for a variable to double, take the number 72 and divide it by the growth rate of the variable. This rule is commonly used with an annual compound interest rate to quickly determine how long it takes to double your money.

The next day we met with Mike Wenzel. He was mainly concerned about our cash flow. Cash flow is defined as the difference between the available cash at the beginning of an accounting period and that at the end of the period. Cash comes in from sales, loan proceeds, investments and the sale of assets and goes out to pay for operating and direct expenses, principal debt service, and the purchase of asset. Cash comes in from sales, loan proceeds, investments and the sale of assets and goes out to pay for operating and direct expenses, principal debt service, and the purchase of assets. Mr Wenzel told us, your cash flow projections are based on the past performance of your business. To project your cash flow, start by breaking down projected sales over the next year, according to the percentage of business volume generated each month. Divide each month's sales, according to cash sales and credit sales. Cash sales can be logged into the cash flow statement in the same month they're generated. Credit sales aren't credit card sales, which are treated as cash, but rather invoiced sales with agreed-upon terms. Refer to your accounts receivable records and determine your average collection period. If it's 30 days, then sales made by credit can't be logged into cash until 35 to 40 days after they're made.

As CEO continues to wind down the business in CEO continues to pick up as Banker Day and the elevator pitch is right around the corner.Jaylen Davis

Friday, March 24, 2017Learn More About Jaylen

This week consisted of mostly learning ins and outs of business, investments, and thinking for the future. On Monday we visited Trinity Financial with Mr. and Mrs. Dunnigan. Have been married 35 years which shows longevity and commitment. Mr. Dunnigan has been in the investment business for 32 years. Both of them are McKendree graduates. Their son is their research analyst. When working, his wife is in one room and his son is in the other. Their other son is a research analyst for the Federal Bank. Trinity Financial is named Trinity due to him being a very Christian man. They originally were in the Copperbend Center. Approximately 57,000 cars drive by their business due to their location which goes to show location is everything. When they manage money they try to find out people's goals. The Rule of 72 teaches you how to make your money double. The greatest invention is the power of compound interest. Stock legal age is 18 which mean we should all start investing soon to seek maximum profit.

On Tuesday, Mr. Mike Wenzel visited us. Mike began his accounting career in 1970 with a major national firm. In 1982, he founded a sole proprietorship in Belleville, Illinois that would eventually become Wenzel and Associates Ltd. Mike works with a variety of privately held businesses. During the past 37 years, Mike has provided accounting, tax and consulting services of all types to virtually every industry segment. Wenzel and Associates Ltd. do not provide services to governmental or not-for-profit entities. Mr. Wenzel also helped me personally for my individual business by showing me and my partner that there is a limit being placed for the city of Belleville that affects thrift stores and resell stores which is a cap of the amount of stores there are.

Royce Payne

Friday, March 24, 2017Learn More About Royce

This week was the twenty-ninth week of class. This week we had one business visit and two presentation days. Our class had a lot time this week dedicated to business plans. Although this week was only four days every day was very productive.

On Monday the class went to Trinity Financial group to see Mike and Verna Dunnigan. Mike and Verna Dunnigan are big supporters of CEO. Mrs. Dunnigan helped out with the Around the Fountain trade show. Verna Dunnigan is the administration part of Trinity Financial group. She is registered with FINRA as a Broker (sometimes referred to as a broker-dealer registered rep, or RR). Brokers are the sales personnel who work for larger brokerage firms. These firms (also known as broker-dealers) are in the business of buying and selling securities such as stocks, bonds, mutual funds and other investment-related products. Mike Dunnigan has twenty seven years of experience as a registered Financial Advisor. He is the Branch Manager and designated Office of Supervisory Jurisdiction with Trinity Financial Group. He graduated from McKendree University in 1982. Mike is a recipient of: McKendree University Baseball Academic All- American, and McKendree Baseball Hall of Fame. He has also received several honors and awards throughout his tenure as a Financial Advisor. In addition, Mike has been an Elder at First Christian Church located in Belleville, Illinois for the fourteen years. His securities registrations include; Investment Company Products/Variable Contracts Principal Series 26; Investment Company Products/Variable Contracts Representative Series 6; Uniform Securities Agent Series 63; and Uniform Investment Advisor Series 65. He is a licensed Life and Health Insurance Producer.

On Tuesday and Wednesday we had presentations from Mike Wenzel, and the US bankers. Mike Wenzel is a CPA of a small family owned business and his specialty is Tax litigation, auditing, and zero base budgeting. He explained contingency expenses and how to start at the end and fill in the middle. He talked about the history of Belleville and how it was stove capital in the 20s and 30s.

The thing that stood out the most this week was what the bankers said about being enthusiastic and reflecting how you feel about your business to others.

Epiphany Smith

Friday, March 24, 2017Learn More About Epiphany

Monday we met at Trinity Financial Group with the Dunnigans. There, we learned about the importance of investing your funds and the crucial knowledge of the rule of 72. Mr. Dunnigan showed us that if someone were to put $2000 in a savings account, after 72 years they would only have $8,000 but if they were to invest it the person would have $8,000,000 (based on the stock market's average return of 12%). If anything he made me feel a little more secure and happy that my parents have helped me set up a mutual fund.

Then Mr. Wentzel came and visited us and taught us about his career as a CPA. Through him I figured out that I should probably register my business as an LLC but definitely copyright my business’s name and logo, which if I start doing well I most definitely will.

We also had some US Bankers come and help us with our financials which was extremely insightful. I truly saw how much this business could make and how much it may cost.

Earlier this month I received some news that was hard to swallow. Building this app could cost me up to $50,000, which for a high schooler is a fortune. However, earlier this week I found out the guy I was talking to can't even build the app, that he is only a financial/business advisor. Luckily he runs a mobile web application business on the side and offered to build a web version of it for free while I work on creating an App Store compatible version. This was a massive weight off of my shoulders and I can't wait to get everything going.

In fact, he has already started on the website and you get a preview of it at http://www.thewatchlist.mobi/ It is not a finished product but it has come a long way already!

Carson Gamboe

Friday, March 24, 2017Learn More About Carson

)

)

)

)

)

)

)

)

)

)

)

)

)

)